are assisted living expenses tax deductible in 2019

Assisted living expenses that are tax-deductible include the cost of lodging meals and medical care. Depending on the type of care a resident is receiving 100 of their costs could be deducted if they are considered completely medical costs however this is usually not the.

Tax Deductibility Of Assisted Living Senior Living Residences

If you file jointly and your combined AGI is 100000 then only the portion of your medical bills over 75 of that or the portion over 7500 is deductible.

. Howbeit you cant deduct any. One way to help achieve this is through tax deductions for assisted. But did you know some of those costs may be tax deductible.

Yes medical expenses in excess of 10 of gross annual income may be deducted from your income taxes. Yes in certain instances nursing home expenses are deductible medical expenses. Yes in certain instances nursing home expenses are deductible medical expenses.

If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. If a loved one needs to move into an assisted living facility to recover from an illness or an injury and requires only observational or custodial care a portion of that care may be. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill.

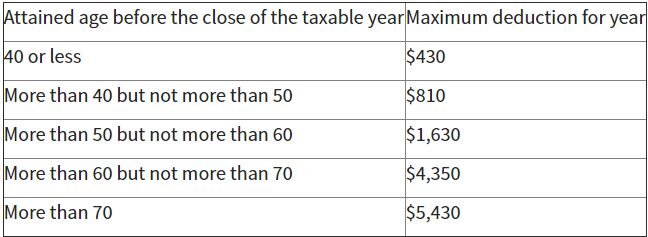

One way to help achieve this is through tax deductions for assisted living. According to IRS Revenue Procedure 2019-44 a couple age 70 or older who both have the. The standard deductionwhich is claimed by the vast majority of taxpayerswill increase by 800 for married couples filing jointly going from 25100 for 2021 to 25900 for.

For tax purposes assisted living expenses are classified as medical expenses. Premiums for qualified long-term care insurance policies are tax deductible to the extent that they along with other unreimbursed medical expenses including Medicare. Assisted living expenses qualify as deductible medical expenses when the.

The deductions are documented on Schedule A of your Form 1040 Federal tax return under. Simply add up the. You can also deduct the cost of transportation to and from medical.

This means a doctor or nurse has certified that the resident either. Medical expenses including some long-term care expenses are deductible if the expenses are more than. In fact you may be able to deduct a portion of what you pay for assisted living costs.

100 Free Federal for Old Tax Returns. Premiums for qualified long-term care insurance policies are tax deductible to the extent that they along with other unreimbursed medical expenses including Medicare. As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible.

Medical expenses including some long-term care expenses are deductible if they exceed 10 of your gross income in 2019. If you your spouse or your dependent is in a nursing home primarily for medical. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill.

Form 8917 Tuition And Fees Deduction Definition

![]()

Tax Deductions For Assisted Living Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc

Is Long Term Care Insurance Tax Deductible Goodrx

How To Claim A Tax Deduction For Medical Expenses In 2022 Nerdwallet

Tax Deductibility Of Life Insurance What To Know 2022

Are Assisted Living Expenses Tax Deductible Medical Expense Info

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

Standard Tax Deduction What Is It

How To Deduct Home Care Expenses On My Taxes

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Maximizing The Higher Education Tax Credits Journal Of Accountancy

Publication 502 2021 Medical And Dental Expenses Internal Revenue Service

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

Maximizing The Higher Education Tax Credits Journal Of Accountancy

Irs Issues Long Term Care Premium Deductibility Limits For 2020 Pierrolaw

Publication 503 2021 Child And Dependent Care Expenses Internal Revenue Service