georgia property tax exemptions for veterans

The exemption is equal to the amount of state tax levy for the residence and up to 10 acres of land surrounding the residence. Qualifying veterans can get a 1500 property tax exemption.

No income information is required.

/PropertyTaxExemptions-5abfea720b6f4b048a2e654e286d7230.jpeg)

. Alaska property tax rates are recalculated each year after all property values have been assessed. Qualifying seniors 65 and older can get 50 up to 400 credit against school property tax for their primary residence. Tax rates are based on the total value of each property and the amount of revenue needed to maintain government budgets.

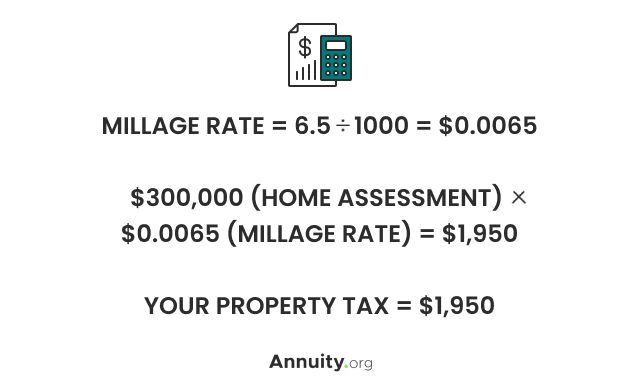

These rates are calculated as mills A mill is equal to 1 of tax for every 1000 in. Additional exemptions based on income and disability. Senior School Property Tax Relief.

Pursuant to Senate Bill 415 effective November 1 2021 all new applicants for sales tax exemption based on a veterans 100 service-connected disability status are required to register in the Oklahoma Veterans Registry to verify eligibility. Application must be filed electronically through the Georgia Tax Center. Veterans Property Tax Exemption.

The tax rate shown on the tax bill will be 0 zero. Alaska Property Tax Rates. There is no longer a State property tax.

Before sharing sensitive or personal information make sure youre on an official state website. Local state and federal government websites often end in gov. Veterans and surviving spouses previously awarded sales tax exempt status prior to November 1 2021 must register in the.

This exemption is in addition to any existing exemptions. Property and services are used exclusively in performing a general treatment function when such clinic is a tax exempt entity under the Internal Revenue Code and obtains an exemption determination letter from the Commissioner. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

770 389-7912 CONTACT LINKS Report a Concern. CONTACT US Stockbridge City Hall 4640 North Henry Boulevard Stockbridge GA 30281 Phone.

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Deadline To Apply For Property Tax Homestead Exemptions Is April 1st News Milton Ga

States With Property Tax Exemptions For Veterans R Veterans

Veteran Tax Exemptions By State

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

/PropertyTaxExemptions-5abfea720b6f4b048a2e654e286d7230.jpeg)

Property Tax Exemptions For Veterans

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

The Ultimate Guide To North Carolina Property Taxes

Property Taxes By State In 2022 A Complete Rundown

Fulton County Sends Out Annual Assessment Notices To Milton Homeowners News Milton Ga

Getting To Know Georgia Property Taxes Wch Homes

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

What Is A Homestead Exemption And How Does It Work Lendingtree

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider